The CBRE released a report titled “Residential Real Estate in India: Challenges and Future Proofing Strategies for Developers” on August 9

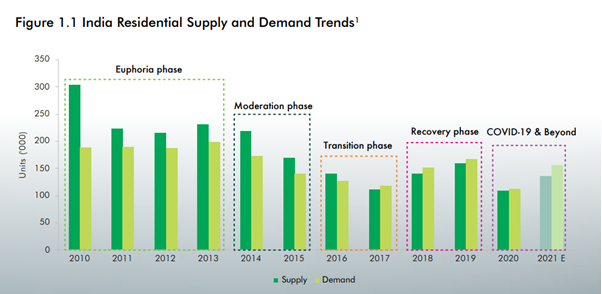

The report stated that despite the pandemic in 2020, housing sales improved in Q4 (Oct-Dec) growing by 73% Q-o-Q driven by Pune, Bangalore, Delhi-NCR, and Mumbai. The trend continued in 2021 as well with housing sales in the first half of 2021 growing by 75% y-o-y.

Property prices, the report said, have grown at a CAGR of 1-6% across the high-end segment and at around 2-7% across the mid-segment since 2010 – “Housing affordability at its highest in over a decade.”

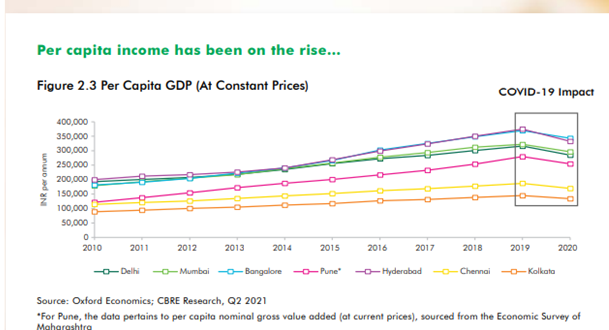

The Per capita GDP grew at a CAGR of 4% between 2010 and 2020 with the top seven cities recording per capita above the national average of 5.3%. Between 2015 & 20, per capita GDP outpaced an increase in property prices thereby “improving overall affordability”, the report stated.

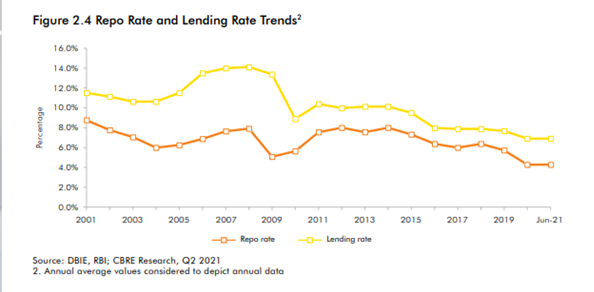

With the onset of the pandemic, the Reserve Bank of India reduced the repo rate to 4% in May 2020 and has since then maintained an accommodative stance. Gradual transmission of rates has led to lending rates dropping to a low of 6.9%.

The government has, through various interventions like reduction in GST, RERA, and other measures kept up the emphasis on affordable housing. From granting infrastructure status in 2017 to the extension of Tax holiday till 31 March 2022 and other measures in the last five years have helped the sector maintain its momentum.

Bank credit remains a hindrance and the sources of funding for residential real estate remain limited, selective, and expensive, notes the report. “Scheduled commercial banks have been selective and lent to only creditworthy projects backed by prominent developers, resulting in limited options for new / smaller developers – a scenario that is unlikely to change soon, especially post COVID-19,” adding “the pandemic has accentuated the problems for NBFCs to disburse fresh loans.”

The report also points to operational constraints that have engulfed the sector. “Key materials such as steel, cement, copper, aluminum, etc. which have a direct bearing on construction costs have witnessed a significant increase in recent months. In addition, labour cost (and now availability) and logistical constraints have exerted pressure on costs,” the report notes.

The report also points to the regulatory constraints. “The approval process could take six to nine months or even more.” Besides, high tax on construction input material is posing a cascading effect. “The GST on key construction material such as marble, tiles, glass and prefabricated structural components, etc. varies between 12-18% for certain input materials. This results in a cascading tax impact on developing housing units and dents the bottom-line, translating into higher unit prices for end-users.”

“While there is a noticeable improvement in the overall Ease of Doing Business Ranking, key parameters such as registering a property, paying taxes, enforcing contracts, and resolving insolvency still need attention,” the report said.

The report points to how the sector combat stress by future-proofing. It said, “Since the fundamentals of the residential sector remain strong (attractive mortgage rates, steady capital values, attractive developer schemes), ensuring timely completions to maintain a steady cashflow stream is an important source of self-financing for RE developers.”

The report points to how technology can be an enabler. “Improvements in construction techniques and adoption of tech can help accelerate timelines, improve quality and, in the long run, reduce costs.”

Concluding the report with emerging trends post-COVID, CBRE says, demand for bigger homes, flexible home designs, demand on rising in peripheral locations, preference for green and smart homes, revamped contact management practices, reassessment of labour management practices are some of the trends going forward.

Also read : Why it is the Right Time to Invest in Residential Properties in Chandigarh.

2 Comments

Comments are closed.