Property Valuation in real estate is like a map for home buyers and sellers, making things easier. It’s more than just a cost estimate; it digs into key ways and different valuations. It affects things like property taxes, insurance aspects, and thoughtful investment decisions. Also, it doesn’t stop there.

It even affects your property taxes, insurance, and where to go for property investment in India. Through this article, we aim to highlight the wide and impactful role of Property Valuation as it shapes the constantly changing real estate scene, emphasizing its importance in the shifting world of property deals.

Table of Contents:

- What is Property Valuation?

- Foundation of Property Valuation

- Property Principles You Should Know

- Property Valuation VS Mortgage Lender’s Valuation

- Why is Property Valuation Important?

- Types of Property Valuation

- Methods of Property Valuation

- Factors Affecting Property Valuation

- Benefits of Property Valuation for Buyers

- Benefits of Property Valuation for Sellers

- Conclusion

What is Property Valuation?

Calculating a property’s market value or worth is called property valuation. It plays a fundamental role in the real estate market. Detecting a property’s value is a detailed task. Experts known as values take it on. They looks into key details like location, size, and condition along with current market trends. The elements are mixed carefully to get a precise cost estimate for the property.

The know-how of these values offers crucial facts for buyers, sellers, and banks. It helps make sure property prices are fair. It also aids smart decision-making. Thanks to the ever-changing real estate market, these valuation skills are important to settle a property at its right price.

Foundation of Property Valuation:

Surveyors ground their tasks in understanding the ups and downs of the real estate market. They keep tabs on trends in the economy, zoning rules, and property laws. Armed with these bits of knowledge, and an eye for property details, they can give balanced and informed property cost estimates.

Evaluators also look at things like the size of the property, its condition, and where it’s located. They check everything to provide a complete picture. This way, different factors affecting the property’s value are acknowledged. With these specifics in mind, evaluations are fairer and much truer to the real pricing.

Property Principles You Should Know

Here’s a guide to property valuation. It’s built on three key ideas – prediction, comparison, and analysis. Prediction involves thinking ahead about future gains. Comparison suggests buyers won’t overspend if an equal property exists.

Analysis weighs how much a specific object adds to the property’s total worth. These concepts are the heart of the valuation process, steering the focus towards future benefits, market competition, and property features. Knowing these ideas is truly important for anyone involved in real estate. It offers a clear view of what influences property value.

Property Valuation VS Mortgage Lender’s Valuation:

A property valuation and a lender’s valuation serve different purposes, but both try to figure out a property’s worth. The lender’s valuation checks if the loan is safe, meaning they won’t lose money.

A property value gives a broader picture. It takes location, condition, and market trends into account. It’s not only about the loan. It’s useful to buyers, sellers, and everyone in real estate.

If you want to know how to finance your commercial real estate investment, then also read the blog A Guide to Loans and Mortgages.

Why is Property Valuation Important?

Property value plays a big role. Sellers use it to price their property realistically. It’s about fair selling. Buyers also use it to make good buying choices. They want to spend wisely. Property valuation is more than just a tool for business transactions.

It’s also key for setting property taxes and insurance premiums, based on the property’s worth. Moreover, investors rely on it to make solid financial choices, which helps keep the real estate market stable. Simply said, property valuation ensures fair practices and is the fabric that ties together our economy.

Types of Property Valuation:

There are many ways to figure out the value of a property. Market Valuation compares it to recent sales. Rental Valuation focuses on how much it could earn in rent. Insurance Valuation estimates rebuild costs if there’s damage. All these types are important for helping various individuals make smart choices, including property buyers, sellers, landlords, and insurance companies.

| Types | About Property Valuation |

|---|---|

| 1. Market Valuation | This approach figures out how much a property is worth. It looks at recent sales of similar properties nearby. This gives a good measure for fair deals. It helps buyers and sellers understand the current market and compare sales data. |

| 2. Rental Valuation | This estimate is useful for landlords and investors. It looks at how much rent the property could bring in. This helps property owners make good choices. It can increase their profits in the fast-changing rental market. |

| 3. Insurance Valuation | Insurance valuation approach figures out how much it would cost to rebuild a property if it was damaged. This is key for deciding on insurance coverage. It makes sure property owners are fully covered. By looking at the cost of rebuilding, it helps manage risks and protect the investment against unexpected events. |

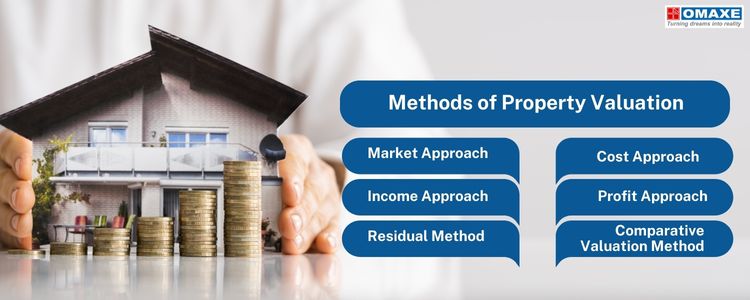

Methods of Property Valuation:

Surveyors use different methods to assess property value. There’s a multi-faceted method of gauging property value. It changes depending on the place and home type. We’ve got the Sales Comparison Method, which looks at similar homes.

There’s also the Cost Approach, which calculates how much a similar new home would cost. And, the Income Capitalization Method, which forecasts potential earnings. These help paint a full picture of a property’s value, considering what makes it unique and how the real estate investment opportunities in India are moving.

1. Market Approach:

This process looks at recent, similar property sales in the area. After noting differences, a fair price is estimated. Especially for those properties in active real estate markets, where you can get sales data easily, this method works great.

2. Cost Approach:

It also gauges a property’s worth based on the cost to rebuild or replace it, while considering wear and tear. It sets a valuation base. The basic idea is simple: a sensible buyer wouldn’t pay more for a home than the price of an equal substitute.

3. Income Approach:

Lastly, it calculates the value from the predicted earnings of the property. This method is common for business and investment venues. This is a handy tool for investors. It helps them figure out how much income a property could bring in.

4. Profit Approach:

The profits method estimates a property’s value based on the profit it has generated for the owner. The firm which is dealing with the property will have an account for the profits and will be reviewed by surveyors.

5. Residual Method:

Residual methods ask the surveyors to deduct the development costs from the property’s worth and the remaining will be the total valuation of the property.

6. Comparative Valuation Method:

This method considers similar properties in the same market. By comparing other property’s values, surveyors decide the value of the subject property.

Also Read: Top 15 Best Cities for Real Estate Investment in India

Factors Affecting Property Valuation:

- Location: The location where a property is situated plays a crucial role in its valuation.

- Amenities: Modern buyers seek comfort. Properties with better amenities will be higher in value.

- Structure of the property: The building’s quality, size, material, and design are important factors in real estate property value.

- Demand and Supply: The demand and supply equation affects property valuation.

- Economic Trends: Economic trends such as the job market, growth, and financial stability impact property valuation as well.

Benefits of Property Valuation for Buyers:

- It helps buyers gain information about the property valuation so that they can buy the property at the best prices.

- Buyers gain an upper hand in negotiation with the seller when he/she knows the true value of the property.

- This valuation can prevent buyers from overpaying for a low-valued property.

- Lenders often use property valuation methods to give financial guidance to buyers.

- Valuation assists buyers in evaluating the property’s future potential as an investment.

Also Read: How to Choose the best real estate company in India

Benefits of Property Valuation for Sellers:

- Valuation sets a realistic price value for sellers.

- It offers a solid ground for sellers to negotiate with potential buyers.

- Property valuation prevents sellers from selling their properties underpriced and helps them avoid the overpricing delusion.

- Highlighting a property’s value enhances the success rates of effective marketing strategies.

- Right pricing will win more sales quickly.

Conclusion

Property valuation is key in real estate property investment in India, whether you’re buying or selling. Knowing the principles, types, and methods used is important. It guides decisions, brings transparency, and helps keep the real estate market healthy. There are different ways to value property, like the Sales Comparison Approach, Cost Approach, and Income Approach. Each gives a unique viewpoint.

Surveyors, who understand economic trends, zoning regulations, and property laws, help keep things balanced. This doesn’t just help with single deals, but with the stability and strength of all real estate. Being the final say in a property’s value, valuation makes sure deals are fair, boosts confidence, and provides a solid base.

1 Comment

Comments are closed.